The growing problem of poor quality finance leads and what to do about it…

By Jake Osborne | Credit Sense The Problem No One Talks About: Lead Quality You’ve invested heavily in paid media. Your cost per lead looks reasonable. The volume is flowing. But there’s a nagging issue: your leads just aren’t converting. This is one of the most common—and costly—problems facing Australian lenders, brokers, and fintechs today….

How Bank Statement Connectivity Issues Are Quietly Costing Your Lending Business

By Jake Osborne | Credit Sense It’s Not Just Friction—It’s Lost Revenue You’ve built a marketing engine. Your pipeline is full. But there’s a leak in your funnel you might be overlooking. Your bank statement connectivity is costing you money. In a world where digital lending moves at lightning speed, delays and failures in retrieving…

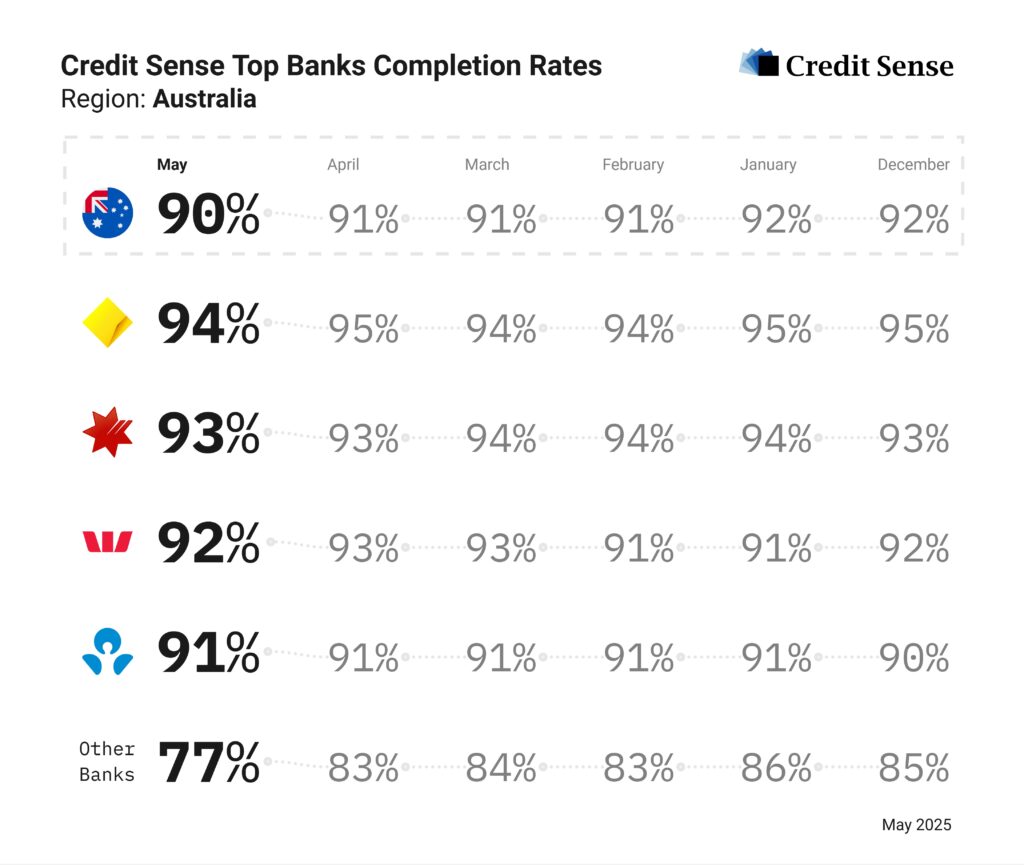

What is completion rate – and what should you expect?

Completion rate in our context is the number of people who complete the Credit Sense customer journey, divided by the number of people who were presented with it. For example, if 100 people are presented with our customer journey, and 10 of them don’t complete it (for any reason), that’s a 90% completion rate. …

Custom insights are here – check our most requested feature

Our custom insights tool enables us to build and deliver custom insights fast. If you find yourself manually calculating the numbers you need to complete a customer assessment, talk to us about automating them. What are custom insights? Custom insights are automated calculations that deliver an answer to a business question. Different businesses use different…

FinTech and RegTech Committee support screen scraping

The Australian Senate Select Committee on Financial Technology and Regulatory Technology released its interim report in September where it recommended that the Australian Government maintain existing regulatory arrangements in relation to digital data capture (screen scraping).1 In its conclusions and recommendations relating to the treatment of screen scraping practices, the committee noted that in its…

Meet our people – Technical Account Manager Naveen!

Naveen began university with the goal of becoming an accountant. He soon realised this was not going to satisfy his curiosity and made the fateful shift to software engineering which has led him around the world gaining experiences that have made him one of our most loved Technical Account Managers (TAM). After a globe-trotting career…